Welcome to Planned Giving

Gifts of Appreciated Securities

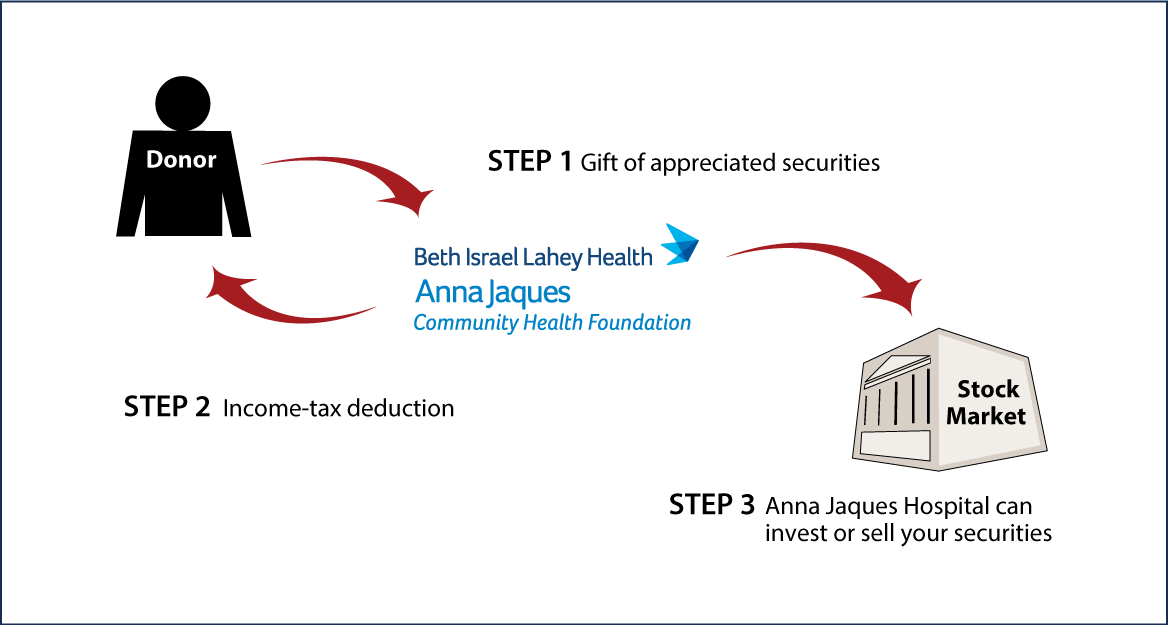

How It Works

- You can send unendorsed stock certificates by registered mail or instruct your broker to make the transfer from your account to our account

- You receive an income-tax deduction

- Anna Jaques may keep or sell the securities

Benefits

- You may receive a federal income-tax deduction for the full fair-market value of the securities

- You avoid long-term capital-gain tax on any appreciation in the value of the stock

- Your gift will support Anna Jaques as you designate

Special note: You should call or e-mail us to tell us of your intent, and we will be able to assist you with the details of the transfer.

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Mary Williamson |

Anna Jaques Community Health Foundation |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer